UKG Inc., a leading provider of HR, payroll, and workforce management solutions announces entering into a definitive agreement to acquire Immedis. Read More

One team, one dream

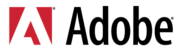

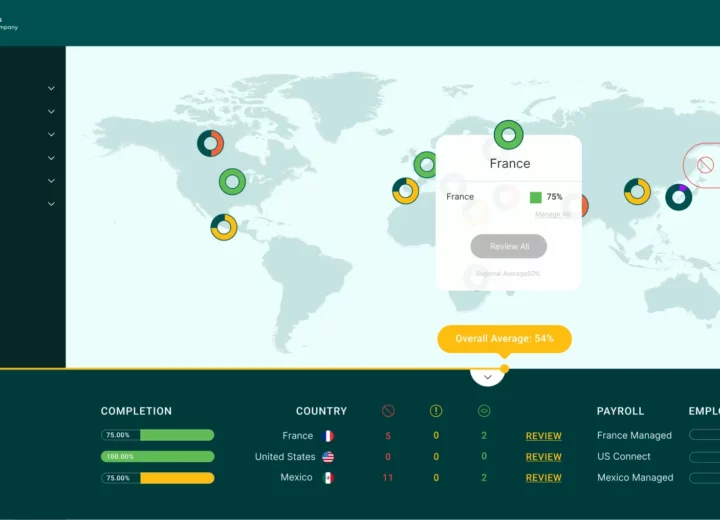

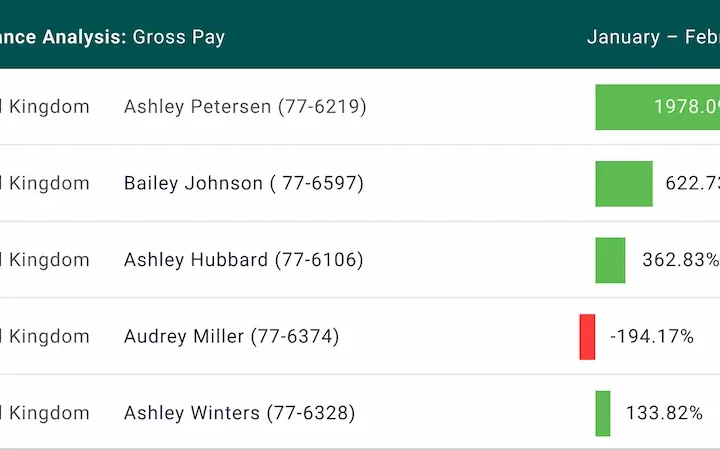

Born from a heritage of complex global and ex-pat tax, we know multi-national payroll.

With years of industry experience, our award-winning team of payroll and tax experts understands what it takes to deliver an exceptional employee experience.