April 6, 2022, sees the start of the 2022/23 UK tax year. UK employers must operate PAYE in real-time to collect income tax (IT) and national insurance contributions (NICs) from their employees as part of their payroll obligations. Employers need to be aware that there are changes to these amounts.

What are the tax rates for the 2022/23 tax year?

Income Tax for England, Wales & Northern Ireland

- The employee standard personal allowance remains at £12,570 per year or £1,048 monthly.

- The basic (20%) and higher (40%) bands also remain unchanged - £37,700 and £150,00 per year.

- Income above £150,000 per annum is charged at 45%.

Income Tax for Scotland

- The personal allowance for Scottish taxpayers is £12,570 per year, with a rate of 19% for the first £2,162 above this personal allowance.

- The Scottish basic rate at 20% is applicable for income from £2,163 to £13,118.

- The Scottish intermediate rate at 21% is applicable for income from £13,119 to £31,092.

- The Scottish higher rate at 41% is applicable for income from ££31,093 to £150,000.

- Income over £150,000 is charged at 46%.

National Insurance Contributions (UK)

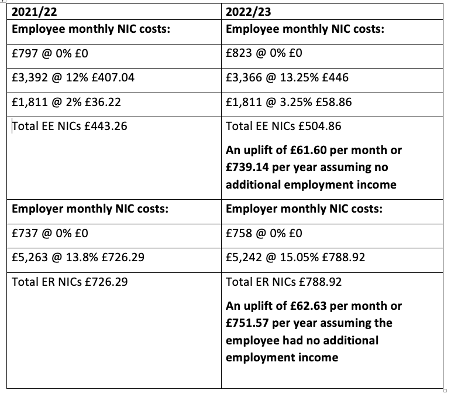

One of the most significant changes for 2022/23 is the increase in the NIC rates. It is expected that the NIC costs are going to increase dramatically.

Employers are required to start deducting NICs on earnings above the lower earnings limit. For 2022/23, it is set at £533 per month or £6,396 per year.

The primary threshold (for employee contributions) is set at £823 per month or £9,880 per year for 2022/23. The upper earnings limit is set at £4,189 per month or £50,270 per year for 2022/23.

The secondary threshold (applicable to employers) is set at £758 per month or £9,100 per year and there is no upper earnings limit for employer NIC liabilities.

The rates for employees are changing from 12% (for income between primary threshold and upper earnings limit) and 2% (for income over the upper earnings limit) to £13.25% and £3.25%.

The rates for employers are changing from 13.8% to 15.05% for NIC Classes 1, 1A, and 1B.

Example calculation for the increased NIC costs:

The NIC costs for an employee earning £6,000 per month in 2021/22 compared with the same in 2022/23. We have disregarded the tax costs in the below example.

To learn about the full Tax Services offered by Immedis, download our taxation brochure.