If you have read through Skills and Competencies Required for the Expatriate Payroll Professional, you may be wondering where should I begin?

The structure of policies that support the vast majority of international expatriate assignments is referred to in the mobility world as “The Balance Sheet” model.I suggest that the first stop on our expatriate payroll tour should be to develop an understanding of the core of most expatriate policies.

Dave Leboff, Immedis US president

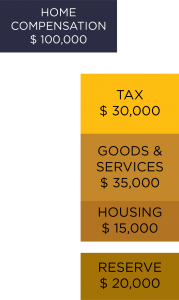

This is poorly named as the expat balance sheet has nothing to do with accounting. The Balance Sheet starts by splitting an employee’s compensation into four parts which reflect what they are used for. The four parts are:

- Tax

- Goods and services

- Housing

- Net reserve

Here is an illustration of what an employee earning $100,000 per year might spend on these various components.

A balance sheet policy will provide additional allowances to ensure that, at the end of the day, the employee is walking away with the same Reserve that they would have had if they remained at home.

Balance Sheet Allowances and Tax

If additional cash is needed in the assignment location to purchase the same set of goods and services that the employee would purchase at home (think “How much does an apple cost in NY versus Paris?” or “How much is a movie in San Francisco versus Tokyo?”), then an allowance is provided for under the balance sheet model.

The same is true for housing.

And each allowance that is provided must be considered for a “Tax Grossup” (Tax and the tax on the tax) or the employee will have to pay for the tax on the additional allowances out of his or her net reserve.

So it is likely that if there are allowances for housing and goods and services, the tax cost will be higher as well, and the grossup will, therefore, have to be paid for by the employer if the reserve is to remain intact. See the illustration below:

In this case, after the additional $10,000 of Cost of Goods allowance and $15,000 housing allowance, the employer must fund an additional $20,000 for the tax grossup so that the employee maintains the $20,000 reserve.

There are many ways that policies deal with these allowances. For example, the differentials can be paid in cash, and housing can be delivered as a benefit in kind with the employer paying the rent in the local currency.

Often, companies running a balance sheet model will retain an amount equal to what would have been the stay-at-home tax. This retention is called “Hypothetical Tax”. Retaining hypothetical tax from the expatriate ensures that the employee pays his/her fair share of tax. In return for the hypothetical tax, the employer pays all of the actual expatriate tax obligations – both at home and abroad. In the case above, the employer would have retained $30,000 in hypothetical tax from the employee and paid $50,000 of actual taxes. Net cost to the employer is $20,000 in this example.

As you can see, processing payroll for balance sheet expatriates is complex. It requires special paycodes to properly report balance sheet items, including hypotheticals. Since there are two payrolls running simultaneously (a home and host payroll), there needs to be close coordination to ensure that all earnings and deductions are properly reported and updated where required to the other payroll. There also needs to be a means to prevent either payroll from duplicating the payment of compensation or expatriate allowance.

To sum, the balance sheet is the policy structure that employers use to protect an employee’s reserve. It provides allowances where the assignment costs exceed those at home, and then covers the tax on those allowances to ensure that the employee is not out of pocket for housing, living costs or tax.

We will discuss more about the balance sheet and paycode strategies in future blogs.