On January 11, 2021, Annex 8 of the Miscellaneous Tax Resolution for 2021 was published in the Federation’s Official Gazette. It contains the new rates for calculating the income tax withholding for individuals, which were introduced due to Mexico’s inflation rate exceeding 11.42%.

What is the impact?

The increase in inflation generates a decrease in income tax for individuals, and an increase in net income will be seen.

The applicable rate during 2021 to calculate the monthly provisional payments and the employment subsidy table.

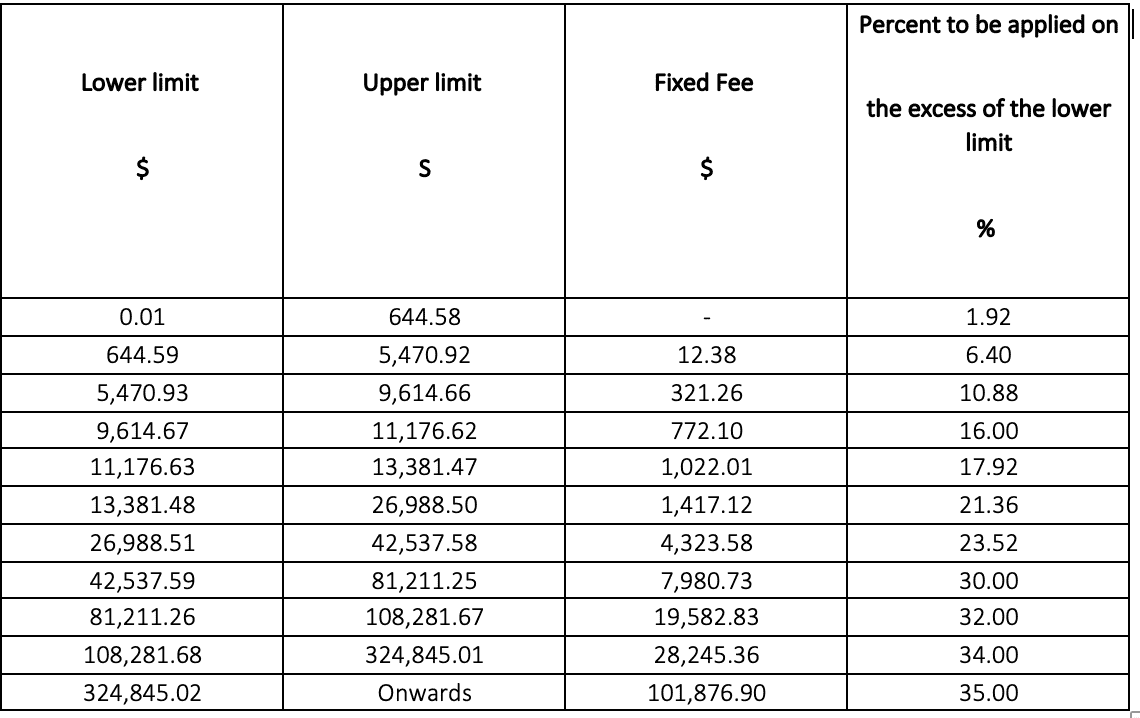

The rate applicable during 2021 to calculate the monthly provisional payments:

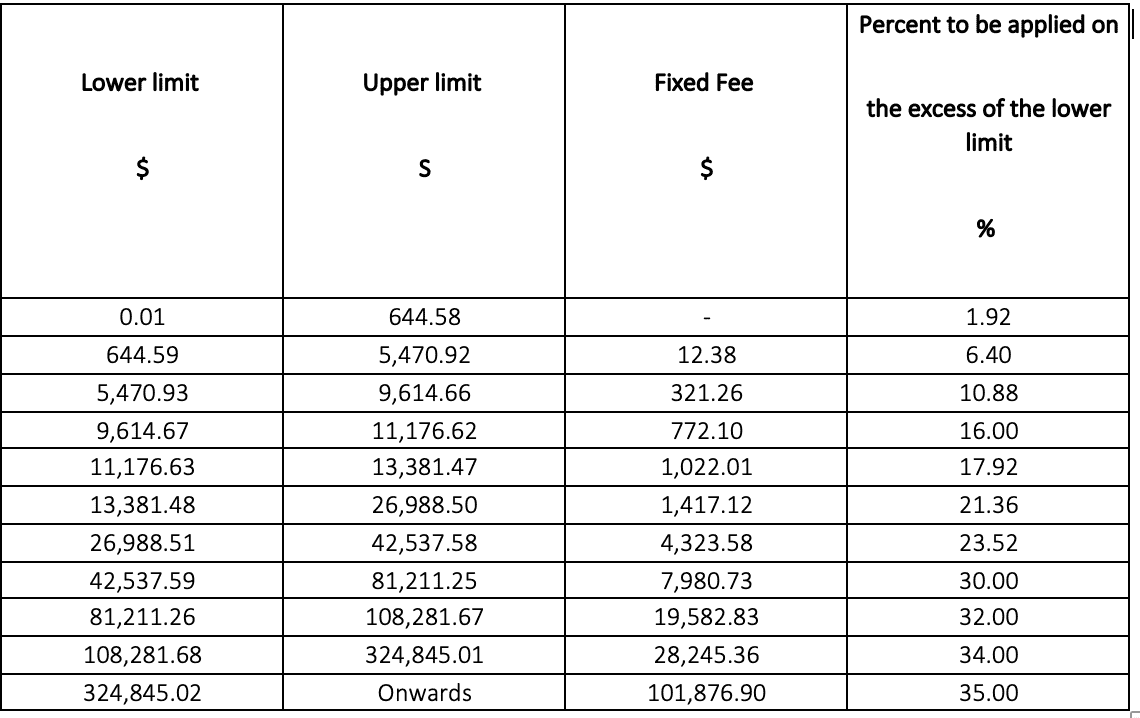

Subsidy table for monthly employment:

All taxpayers must update their payroll systems rates so that the ISR withholding and/or the Employment Subsidy are calculated correctly from January 2021.

Additional reading:

Criterios No Vincluativos de las Disposiciones Fiscales

Back to all country updates