We talk a lot on this blog about the critical role payroll plays within every organization, no matter the size. It is, after all, responsible for making sure that the company is not only in compliance with statutory regulations but also responsible for making sure people get paid. Money that is used to feed, clothe and pay essential bills. While the work of payroll professionals is recognized during national events such as National Payroll Week and Global Payroll Week, most of the time, they go unrecognized and are only contacted when something goes wrong.

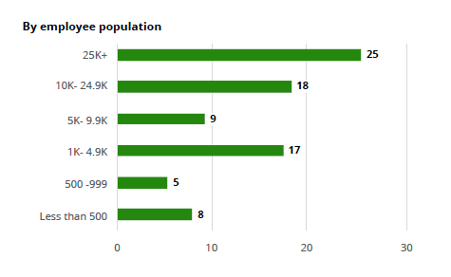

But behind the scenes, the effort that goes into making sure that the correct money is paid into each bank account and all state and local taxes are submitted on time is tremendous. Often the task is completed by a surprisingly small team of professionals. The latest research illustrates that the larger the organization, the fewer there is managing payroll.

How many full-time employees resources support payroll?

Source: Deloitte

When asked in the survey how many employees per payroll FTE, the results might surprise you. In APAC and North America, the highest number of employees served per payroll FTE at about 1,100:1, while LATAM and EMEA average about 320:1. The ratio tends to be quite high in the US, where payroll teams operate at almost 600 employees per payroll FTE.

Some other key insights gleaned from the report include

- Timekeeping is still primarily owned by payroll

- Accuracy and efficiency metrics continue to be largely tracked by payroll

- Manually entering or loading payroll inputs takes up much of a payroll professionals time

What this all tells us is that payroll professionals continue to be burdened with time-consuming work, which is ripe for error- especially when handling large volumes under tight deadlines.

Managing a payroll team

With all that in mind, it is time to turn our attention to those in charge of such teams. I’ve heard from many of our customers that their role involves not just handling the day to day business of payroll, but all the other elements- benefits, accounting, compliance, - to name just a few- while also dealing with multiple time zones, different languages, and cultures and the myriad of changing legislation. All of which contribute to making managing such a team quite challenging.

From their feedback, I’ve compiled a list of the best advice they have to offer.

It is critical to keep all channels open and for managers to ensure that team members feel supported when sharing their concerns. Most teams are dispersed globally and are therefore operating in different time zones. While this can present an additional hurdle, it is important to recognize and aim to hold regular meetings at a time that works for most.

All leaders need to possess soft skills, those somewhat underrated abilities overlooked for technical expertise but essential for collaboration and good leadership. There is plenty of free training available to develop these skills, and I encourage everyone to invest the time and take some courses. I’ve spent the last few decades in leadership roles, and I can always tell those executives who’ve nurtured their soft skills from those who have not.

Payroll is cyclical, making it easy to predict that certain items have to happen. However, a good payroll manager is always looking to be ready for those unexpected changes, those off-cycle payments - through terminations or missed HR updates. 38% of off-cycle payments are a result of upstream processing issues- conduct reviews of all your processes to remove any potential roadblocks

- Track and record everything

Deloitte’s research shows that there has been a significant increase in tracking KPIs related to accuracy and timeliness. Other top metrics include how long it takes to resolve payroll errors and the average cost per payslip. To ensure your team is keeping the relevant data, it is important to enable your teams to monitor and evaluate its performance. Offer the appropriate tools and training as needed and perform regular audits of your team to provide the necessary data.

Staying abreast of payroll and tax legislation changes is no small feat. One global payroll manager I spoke to explains that they ensure all team members are kept current by using tools such as Teams to share links to updates or thought leadership trends. This way, everyone benefits from multiple resources without each person investing the time and duplicating efforts.

- Avoid sharing data -security risk

Promote the technology of your payroll platform to minimize the likelihood of a data breach. Where applicable, encourage the organization to adopt employee self-service capabilities. This reduces the amount of personal data being transferred via email and instead allows employees to input and update their records.

- Leverage technology to automate

As mentioned, much of a payroll team’s time is consumed by repetitive manual tasks. As Alan Jue Liu, our CTO explained in Moving Away From Manual Payroll Processing, technology constantly evolves. While framework level technologies were generic in the past, that is no longer the case. Modern technologies like RulesEngine, compute engine, and reference data management (RDM) make it much easier for businesses to be agile and nimble when deploying applications. The business logic behind them saves development costs, making businesses highly agile enabling faster scalability. Payroll managers must now ensure that they proactively adopt these technologies to enjoy improved efficiencies across their teams and the entire payroll function.

- Realize the power of data

Payroll has at its fingertips robust workforce data, and payroll managers must use these insights to demonstrate to other business functions the pivotal role it plays within the organization. This will help HR, Finance, and other areas understand what payroll contributes and how to work with that knowledge to improve processes. In turn, this can mean a better working relationship with these other areas for your team and improved performance with better alignment of goals and strategies.

What other suggestions can you offer? I am always interested in hearing from readers about their experiences.