Using Technology to Increase the Power of Payroll

In Moving Away From Manual Payroll Processing, I looked at how technology and our expectations post-Covid are changing how we approach payroll processing. The benefits of payroll automation include:

- Fewer errors and mistakes

- Reduced processing time and costs of manual labor and resources

- Better knowledge and insight across payroll teams

- Real–time change and adaptability to business and market need (something we are all very familiar with now due to the past 18 months.)

- Improved working experience increasing productivity

- A one-stop, end-to-end payroll solution

How companies are taking advantage of new technology

What’s so exciting is that not only is technology improving the way we work, it is also undergoing massive change, making it easier to manipulate and work with. Companies can now take advantage of microservices architecture and infrastructure to make them way more scalable and flexible than monolithic techniques.

A key example of this is the phenomenal growth enjoyed by Netflix, a pioneer in the field of new technology and microservices resilience.

We’ve also witnessed massive growth in integration technologies such as integration engines. These systems make it easier to merge technological systems such as payroll and HCM. Now, the HR data that resides in your HCM can flow seamlessly into payroll and help with D&I initiatives and other workforce analytics.

What I am enjoying most of all is the shift in how we can collect and utilize data; there are now incredible advances that make data even more valuable than before. We’ve rules engines enabling the creation, management, and deployment of mathematical formulas and algorithms near real-time. We also have powerful indexing engines that allow searching and accessing past and present data in real-time.

Although exciting in themselves, this technology is hugely advantageous to payroll, giving it the insights and data power to affect real business change and improve outcomes across the organization. All with minimal effort and yet has the potential to elevate payroll within your business.

Robotic Process Automation (RPA)

When talking about technology, one of the most frequent questions is about RPA and how it can support businesses. Let’s start by breaking it down into the simplest of terms- RPA takes everyday manual tasks and automates them. It can refer to something as simple as Excel Macros or as advanced as a workflow across multiple systems.

Here are a few examples of how Immedis, as a payroll vendor, uses the power of RPA to improve efficiencies in payroll processing.

1. Improve payroll accuracy

We use Perpetual Validation to continuously check and validate the employee information to ensure that the required payroll data is present and the employee will get paid correctly.

To learn more about Immedis Perpetual Validation, you can download our brochure here.

2. Integrate with HCMs

We use RPA technology with APIs or connectors to work with in-country partners and HCM like Workday, UKG, Ceridian, and SAP. This allows HR data to flow seamlessly between these systems.

3. Allow changes

With RPA, our customers can make changes at stages in the automated process to make a manual adjustment – which, as we all know, happens a lot in the payroll industry.

4. Generate reports

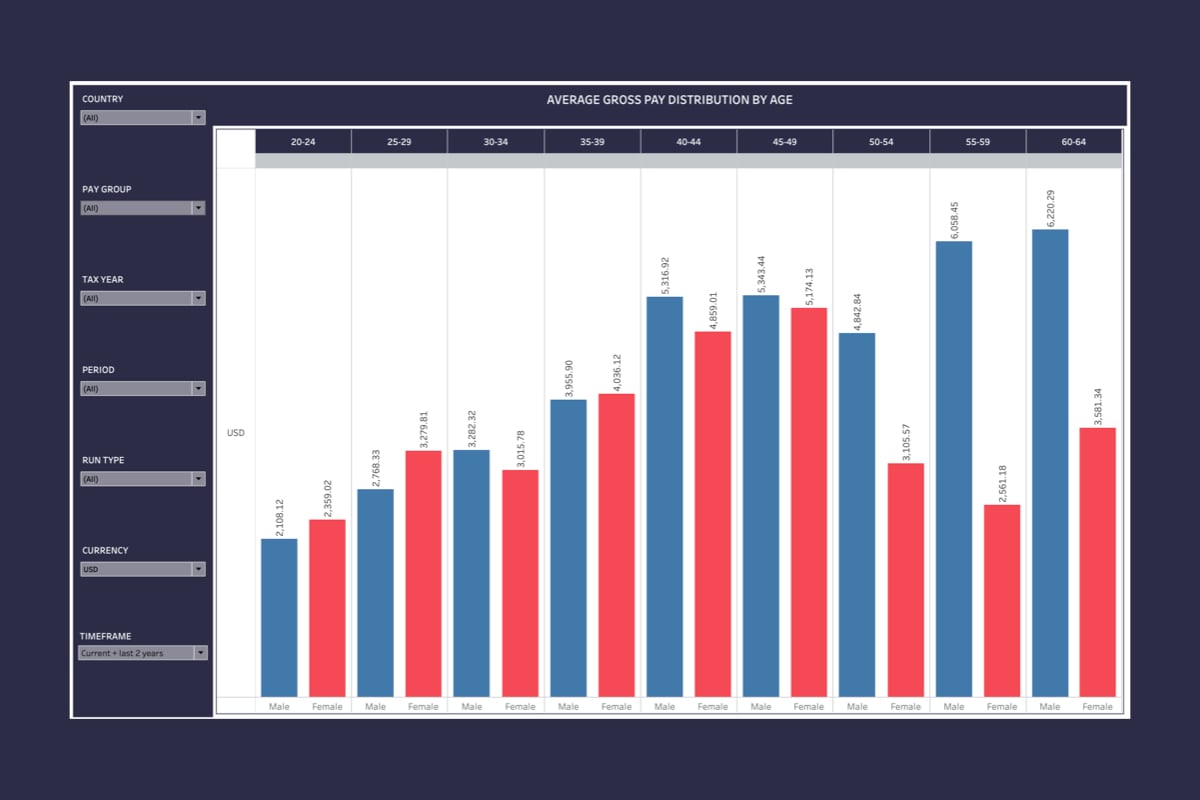

We use RPA technology so that our customers and users can benefit from a range of reports from variance analysis to gender and age gap across the organization.

Artificial Intelligence (AI)

AI technology is different from RPA because it is more directed at identifying patterns or extracting information from a dataset. For example, with AI, you can review your global payroll data and highlight anomalies or trends that you may have been unaware of or knew but needed the data to prove. To work, AI technology needs consistent and clean data that you train and model to align with your needs.

How Immedis uses AI to assist payroll professionals in their job

Provide better reporting and analytics

Detect payroll abnormalities – what happens when your CFO alerts you to the fact that payroll costs more this month than in previous months? How long would it take to sift through all the payroll data to identify where and why there is a difference? Using AI technology, our payroll platform can create variance reports, that when you drill down, shows you that the reason for the change resulted from one employee in Brazil who was paid a large amount for overtime.

Improve the Immedis Platform experience

There will always be a level of inputting in payroll. We understand that, but we also want to help reduce the effort. Immedis offers auto-completion and user input suggestions based on what you are entering and the screen you are using with AI. We also can show the most relevant information to you- again to make your job easier.

Assist with integrations

Integrating technological systems has its challenges - and getting the correct data transferred is central to the task’s success. As Dave Muldoon, our Director of Solution Architecture and Integration, always reminds us, having the correct data is essential for payroll processes, making it critical to use the right connections from the outset. We use AI technology to select the best connectors to use, the quality of the dataset, and analyze the quality of ingested data.

Compliance

Every country has different payroll and compliance requirements- some want employees to identify their religion, others the expected birth date of a child. Failure to provide this information can result in an employee being incorrectly paid and breach compliance regulations. With AI, we can ensure that you have all the necessary information required to process payroll in multiple countries. Take a look at how our technology works below.

Many innovations and technologies today share a goal of making life easier. For example, ordering food or a taxi, watching a movie when you want in the comfort of your own home. We are looking to apply these key principles to the Immedis Platform so that our technology assists payroll professionals and payroll teams in completing and delivering their payrolls and elevating the function of payroll within the company.

To hear more about the importance of technology in payroll, check out my presentation on Future Payroll Tech.