While both Service Organizational Control (SOC) audit reports and the Sarbanes-Oxley Act (SOX) concern compliance and serve as protective agents for consumers and organizations, there are fundamental differences. SOC reports refer to an audit of internal controls to ensure data security, minimal waste, and shareholder confidence; SOX relates to government-issued record keeping and financial information disclosure standards law. In other words, one is about keeping information safe, and the other is about keeping corporations in check.

SOC audit reports

SOC audits are incredibly granular, internal control reports that provide a great deal of transparency for shareholders, investors, and future auditors. Their purpose is to make sure the information and data you store are accurate and protected at all times.

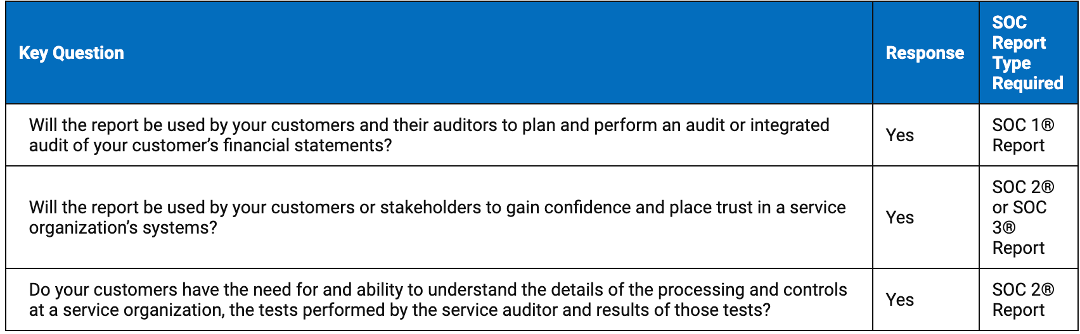

There are 3 types:

SOC 1- These audit reports relate to an organizations’ internal control over financial reporting and are conducted against the assurance standards ISAE 3402 or SSAE 18.

SOC 2- These audit reports are an important component in regulatory oversight, vendor management programs, internal governance, and risk management.

SOC 3 - These audit reports are for general use and cover security and privacy controls for those organizations who don’t need or have the necessary knowledge for a SOC 2 Report.

SOC audits yield a robust report that other auditors can use. It covers all the bases, saves on audit time, and cuts the costs of the project. A SOC audit also provides accountants with the comfort and confidence around their financial projects and planning. These reports boost shareholder confidence, minimize potential security breaches, and significantly cut waste throughout the organization’s processes and procedures.

Sectors who utilize SOC audit reports include:

- Healthcare & medical practices

- Data centers

- Banks & investment firms

- Co-location service providers

- Tax service providers

- Any organization that cannot afford a data breach.

Global payroll and SOC audit reports

The significance of SOC audits and payroll cannot be overstated. Payroll is after all one of the largest operating expenses and it involves highly sensitive employee data such as bank details. Therefore, when selecting a payroll vendor, it is incumbent on an organization to check that the vendor can provide the relevant report.

Source: SOC for Service Organizations: Information for Service Organizations

SOX explained

Remember the Enron scandal? How about WorldCom? These early-2000, high-profile financial disasters rattled investor trust and consumer confidence. To prevent anything like this from happening again, the US government passed the Sarbanes-Oxley Act of 2002.

SOX protects shareholders and the general public from accounting fraud, miscalculated financial records, and potentially harmful corporation disclosures and practices. SOX is monitored by the US Securities and Exchange Commission (SEC) and impacts both the financial and IT departments of a corporation. While SOX compliance doesn’t tell you exactly how to run your record-keeping, it does spell out what controls should be in place to provide accurate financial statements.

If an organization fails to comply with the mandates as laid out by SOX, they face fines and/or imprisonment. It can also result in reputation damage, and in some cases, the collapse of the enterprise. The US government is very strict about compliance, and it is in an organization’s best interest to adhere to the compliance rules.

Sectors who utilize SOX audit reports include:

- Publicly traded companies

- Wholly owned subsidiaries of publicly traded companies

- Non-US-based publicly traded companies

- Private companies preparing to go public (IPOs).

Consolidating your global payroll helps with meeting SOX control requirements

Managing global payroll on a single centralized solution standardizes all your payroll processes, thereby offering greater governance oversight and documentation of controls. Also, when you integrate payroll with your HCM and General Ledger, it reduces the risk of human error and assists with accuracy and consistency across your records. With a global payroll solution such as Immedis, you have the additional advantage of tech-enabled compliance advancements like Perpetual Validation, enabling you to have total confidence in the accuracy of your data. Plus, because you can access all your workforce data in real-time when conducting an audit, you are assured that the information is current, and you can quickly identify and investigate variances in payrolls globally.