What to Look for When Selecting a New Global Payroll Provider

Mark Graham

Chief Commercial Officer

UKG Inc., a leading provider of HR, payroll, and workforce management solutions announces entering into a definitive agreement to acquire Immedis. Read More

Chief Commercial Officer

The answer to this seemingly straightforward question is, in fact, quite complex. It is tempting to dismiss choosing a new global payroll provider as simply reviewing the level of service, the technology and selecting a vendor that matches your requirements at the right price. However, such a view significantly underestimates the real power and potential of payroll.

Today most organizations are beginning to recognize, as noted in the Guide to Global Payroll Management that, “While payroll is not widely considered a strategic function, it can have a significant impact on an organization.”

It’s a view echoed in Deloittes’s 2019 payroll benchmarking survey as respondents confirmed the growing importance of global payroll operations. Eighty-eight percent of respondents either have a payroll strategy or have plans to develop a strategy, almost a 40% increase from the previous year.

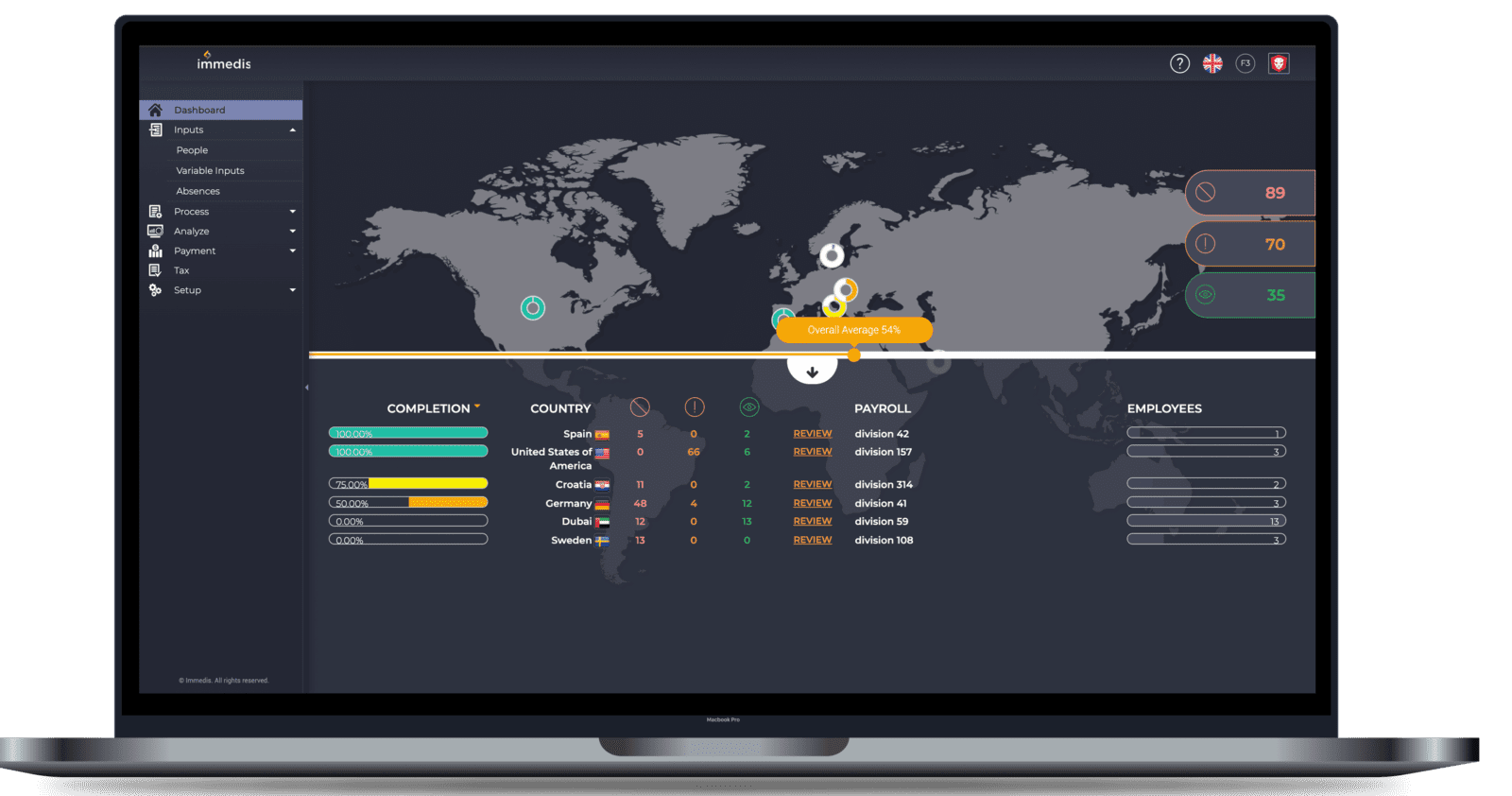

Again, there are many answers to this question. Business leaders recognize that with a more holistic approach to payroll, they can access invaluable data such as labor cots across their entire global workforce leading to better-informed decision making around where to expand or contract future business enterprises. Therefore, having a single source of information, and collating and interpreting real-time data from multiple countries and locations becomes paramount.

The Guide to Global Payroll Management lists how with a unified global payroll, business leaders can:

In short, executives want both the broad view and the capabilities to drill down into specific geographic locations to better understand the real cost of doing business in each country.

Choosing a new global payroll platform requires planning and preparation. As you review each vendor, be sure to include the following areas in your evaluation.

First, you need to understand the difference between the two offerings. In the most basic terms, with a cloud solution, your data is stored in the cloud, and you access it via the internet. On-premise means that the solution is stored on a physical device and stored in an in-house server.

As reported in the Guide to Global Payroll Management, cloud-based solutions are steadily becoming an important aspect of technology within an organization due to its efficiency and global accessibility. The guide also recommends that companies use the following criteria when evaluating payroll providers:

It is imperative that payroll is part of the whole enterprise-wide landscape so it can serve and empower organizational decision making. Look for a solution that easily integrates into your existing systems- from HCM to HRIS and Finance. Read our blog, 4 Benefits of Payroll and HR/Finance Systems Integration for additional insights into the advantages of this union for payroll and the organization.

Payroll data is the most sensitive information that can be held in an organization – bank account details, social security numbers, salary, date of birth, and home address. Ensuring data protection compliance in the payroll process is vital when choosing a global payroll solution. Data at rest or data that is stored in a physical file is the most significant data risk to an organization. You need to ensure your vendor can eliminate these risks.

The introduction of GDPR in 2018 changed payroll forever. While not the only regulation payroll must comply with, its extensive reach means companies are under greater pressure to ensure they are adhering to the law.

Above all else, if your technology and your payroll service provider are not compliant with the law and relevant regulation, your organization will be accountable as well. Breaches can result in hefty fines and long-standing reputational damage.

Most multinational organizations leverage local payroll processing services to ensure compliance and understanding of local laws. Consequently, new generations of specialized software were developed due to the speed and complexity of operating a global payroll. They assist organizations with the secure management and transmission of data. They also ensure that the data is accessible and available for reporting and analytics in real-time for those who have permission to view or manipulate it.

As you evaluate vendors, make sure you understand how they propose to oversee and govern these relationships, paying attention to topics like compliance and data security. I recommend asking the vendor about their ability to easily upgrade and adapt the software to add more countries, staff, and stay current with innovative developments in technology.

As recorded in the 2019 EY Global Payroll Survey, 20% of payroll professionals recognize management reporting was one of the top three payroll operations challenges apart from legislative compliance and organizational consistency. With the introduction of a new technology solution, this is the best opportunity to map out the reporting needs and insights requirements of your C Suite. Plan the best fit solution for gathering global data and collating it into intelligent but easy to access reports.

Your organization can save a considerable amount of time and effort while continuously reducing errors in the payroll life cycle through the automation of time-consuming processes. Validation of information through automation is the future of global payroll. Look for a vendor who provides automation and supports the work via an expert tax and payroll team, adding value at every level.

I also recommend asking whether the platform gives administration and employee access to view payslips and other relevant information.

Customer service and the service-level agreement (SLA) is another decisive factor. While a robust platform is vital to payroll success, the payroll provider’s service is equally critical. Even with the greatest technology, poor service can cause delays, errors, and immense frustration. In research by Immedis and the Global Payroll Association (GPA), we asked respondents what the top three challenges they were experiencing:

Do these answers surprise you? Interestingly, the challenges are almost evenly divided between response times, the level of service, and a lack of integrations.

Source: Do service providers still provide a service?

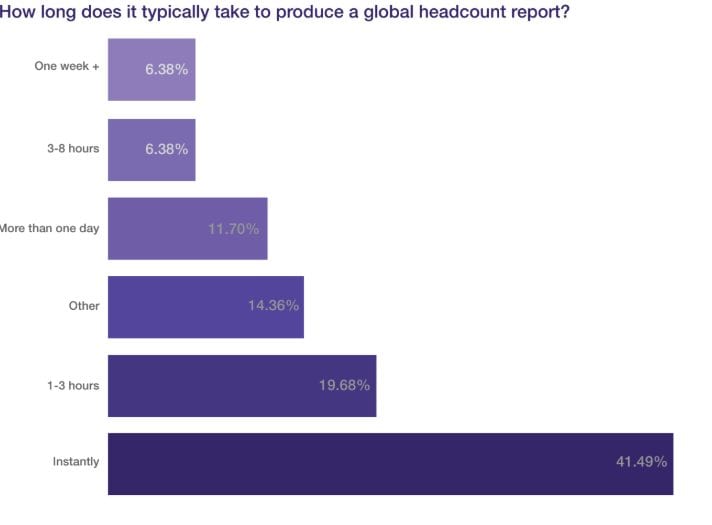

It is impressive that over 41% say they can generate a headcount report instantaneously. What is less impressive is that for almost a fifth, it takes a couple of hours.

When asked if their provider understood their business requirements, just over half (54%) of respondents said yes.

Look for the following with the service provider:

Operating global payroll means having access to a customer support service around the clock to align with the different time zones in which you operate. How will your team in New York handle Sydney’s issues quickly without causing delays to your payroll calendar?

An integral part of consolidating global payroll is to streamline the payroll process. It improves both the flow of work and communication and the relationship between the organization and the vendor.

Having a vendor with in-house tax experts who can advise on tax obligations and rules in the countries and locations which you operate is a valuable asset to have for efficiency and to ensure compliance.

For additional guidance and help with your RPF journey, download Getting the most out of your Global Payroll RFP today.

Immedis Blog

.jpg)