With the massive mandate in the General Election of India 2019, the Modi 2.0 Government set a new target – for India to become a $ 5 trillion economy by 2024.

The Modi 2.0 Government presented the Union Budget on the 5th July 2019 where the Budget focused on several planned transformational reforms. Tax reforms were one of the most important aspects and focused primarily on growth, transparency and simplified tax administration.

Labour reform is also carried out by the Government of India and focused on uniformity and ease of doing business.

Below are some of the planned reforms of the Union Budget:

1.Income Tax Changes

- Deduction for interest paid on loans for purchasing electronic vehicles

Additional income tax deduction of INR 150,000 on the interest paid on loans taken to purchase electric vehicles.

- Interest deduction for affordable housing

An additional deduction of up to INR 150,000 for interest paid on loans borrowed up to 31st March 2020 for purchasing an affordable home valued up to INR 4.5 million.

- Additional surcharge on income exceeding INR 20 million

- 25% surcharge for individuals with taxable income of INR 20 million up to 50 million.

- 37% surcharge with taxable income of INR 50 million and above.

- Surcharge of 10% and 15% for incomes above INR 5 million and INR 10 million respectively continues to exist.

2. ESIC (Employee State Insurance Organization)

The ESIC Employee contribution rate is being reduced to 0.75% (from 1.75%) and the Employer contribution is reduced to 3.25% (from 4.75%) with effect from 1st July 2019.

Additionally, in the state of Maharashra, the Public Health Department has issued a notification under the ESIC that if any shop, establishment or office has 10 or more employees, then the ESIC will be applicable with effect from the 1st of September.

3. Minimum Wage

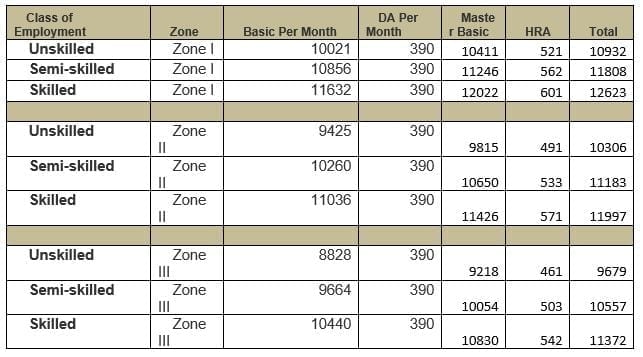

There is a major change within the state of Maharashtra – the minimum wages, Base salary has been revised with effect from July 2019.

The government had not changed the Basic wages in the state of Maharashtra in the past 9 years and this year they made an increase of almost 50% in Basic pay.

Below is the is the updated wage chart as per the new changes –

4. PF e-nomination

A PF (Provident Fund) member should update their e-nomination through the UAN member portal – ask employees to update it if they haven’t previously done this.

Once an employee logs in to the UAN member portal they will get the below alert:

5. Code on Wages Bill 2019

This is big move from the government in reforms of old existing India labour laws.

The Lower house of the Parliament of India has passed a Code on the Wages Bill 2019. The Upper House of the Parliament and President of India’s approval is still pending.

Once they approve, then it will become an Act.

The Code replaces the following four laws:

- The Payment of Wages Act, 1936,

- The Minimum Wages Act, 1948,

- The Payment of Bonus Act, 1965,

- The Equal Remuneration Act, 1976.

The Code will apply to all employees.

The Code on Wages seeks to universalize the provisions of minimum wages and timely payment of wages to all employees, irrespective of the sector and wage ceiling.

The introduction of statutory floor wage under the bill will be computed on the basis of minimum living conditions and will extend quality living conditions across the country to about 500 million workers. It is envisaged that states will notify payment of wages to workers digitally.

This is the first code and others will be passed in the coming Parliament session. Labour ministry has decided to amalgamate 44 labour laws into four codes that include codes on:

- Wages

- Industrial relations

- Social security

- Safety, health and working conditions.

This will rationalize labour laws and ease of doing business.

The Finance Minister, Nirmala Sitharaman says;

“This will ensure that the process of registration and filing of returns will get standardized and streamlined. With various labour related definitions getting standardized, it is expected that there shall be less disputes”.

This blog was written by Immedis’ In-Country Partner, Payline India.

Back to all country updates