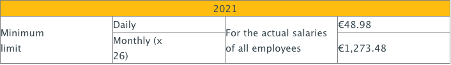

The National Institute for Insurance against Accidents at Work (INAIL) has announced the minimum limits of daily taxable salaries for the calculation of insurance premiums for 2021. These minimum limits must, where lower, be adjusted to 9.5% of the amount of the minimum monthly pension payable by the Employed Workers Pension Fund (FPLD), in effect on 1st January of each year and updated according to the ISTAT index. For 2020, the percentage change calculated by the Italian National Institute of Statistics (ISTAT) was equal to -0.3%, and therefore, to be valid for 2021, the minimum limits for daily salaries for all employees remain unchanged compared to those of 2020.

In 2021, the minimum limit for daily salaries is €48.98, equal to 9.5% of the amount of the minimum monthly pension payable by the pension fund. This amount corresponds to the daily minimum to be compared with the revalued minimum limits for each sector, qualification, and category. Actual salaries cannot fall below these limits, which are adjusted, if lower, to €48.98.

Certain salaries are excluded from this adjustment -agricultural workers, supplementary social security benefits, social security benefits, allowances or indemnities paid to the unemployed engaged at school and work sites, reforestation and mountain accommodation, and allowances provided for intermittent employment contracts.

Effective salaries for all employees

Employees with conventional annual remuneration equal to the minimum annuity.

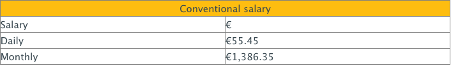

The conventional remuneration for prisoners and inmates, students on vocational study courses, those engaged in socially useful and public utility jobs, those engaged in training and careers guidance internships, employees suspended from work used in training projects or retraining, Honorary Justices of the Peace and Honorary Deputy Prosecutors, is as follows:

Family members operating in a family business

The minimum limit for daily salaries for family members operating in a family business is €55.68.

Collaborators

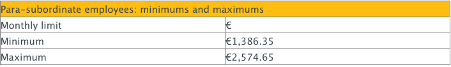

It should be noted that for para-subordinate employees, the monthly minimums and maximums valid are:

Management employees

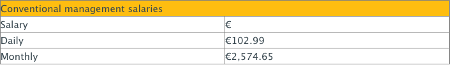

Managers without part-time contracts

Management employees are those with managerial qualifications and those who, despite lacking such qualifications are located in a managerial area as governed by specific collective agreements (employees with managerial duties or functions)

Managers with part-time contracts

For management employees with part-time contracts, the hourly annuity ceiling must be calculated, to be multiplied by the time as defined in the part-time employment relationship.

![]()