If you manage the payroll of an individual working on a temporary assignment in Ireland, do you know how to handle subsistence expenses? Revenue generally accepts that tax-free subsistence may be paid or reimbursed for the first 12 months of a temporary assignment, provided that the period of appointment in Ireland does not exceed 24 months.

According to Revenue, what is considered a temporary assignment and temporary assignee?

A temporary assignment in Ireland is one where

(i) the assignee resides temporarily in Ireland for the performance of the duties of their employment (foreign-held employment); and

(ii) there is the intention that the assignee will return to work in their home country at the end of the assignment.

A temporary assignee in Ireland is an office holder or employee who

(i) holds foreign employment with a non-resident employer and, before coming to work in Ireland, was employed outside of Ireland for not less than 3 months by that employer; and

(ii) holds a temporary assignment (as defined above) in Ireland on behalf of their non-resident employer; and

(iii) actually performs the duties of the foreign employment in Ireland for the period of the temporary assignment; and

(iv) remains an employee of that foreign employer while on temporary assignment in Ireland.

However, a temporary assignee does not include an individual who

(i) is recruited to work in Ireland, or

(ii) in the normal course of their duties, they are posted or transferred from country to country.

Please note it is expected that the assignment in Ireland does not exceed the period of employment with the employer outside Ireland before the start of the temporary assignment.

Subsistence Expenses for Temporary Assignees

The reimbursement of expenses can be either vouched expenses or a flat rate.

Vouched expenses

The reimbursement of vouched expenses free of tax must not exceed the cost of reasonable accommodation and meals while on a temporary assignment. And they can be made for a maximum of 12 months.

Where an employer is reimbursing the cost of hotel accommodation for a temporary assignee, reasonable accommodation will cover the cost of accommodation for up to 12 months. If a spouse and children accompany the employee to Ireland, reasonable accommodation includes hotel accommodation for the spouse and children for the first month only to help procure rented accommodation.

For rented accommodation, reasonable accommodation includes vouched rent, rental of furniture, and payment of utilities, for example, light and heat. Where a spouse and children accompany the employee during the temporary assignment period, reasonable accommodation includes rental of appropriate residential accommodation.

Flat rate expenses

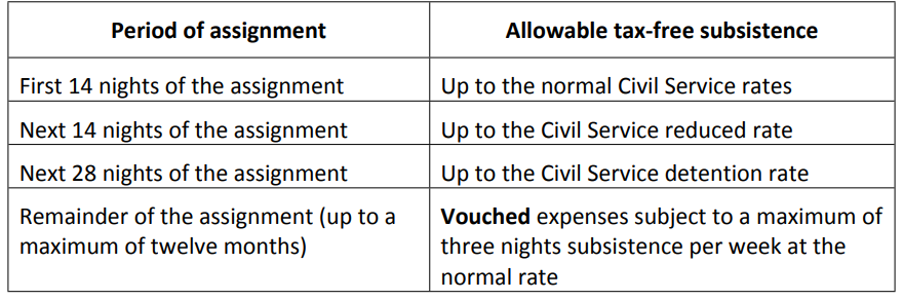

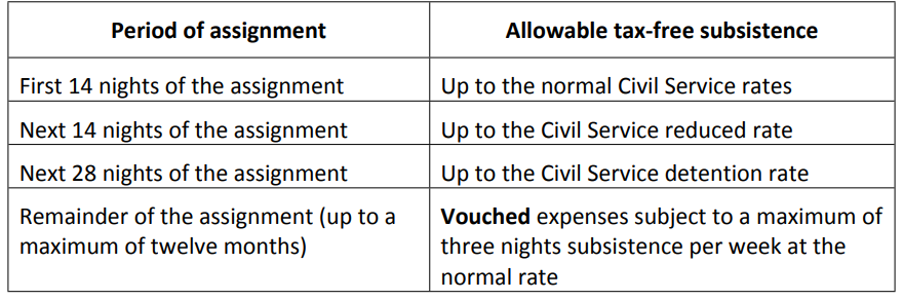

Flat rate reimbursement of expenses free of tax for the temporary assignee only based on the Civil Service schedule of rates must not exceed the following.

Travel expenses for temporary assignees

Any expenses paid or reimbursed free of tax include the vouched cost of the journeys to and from Ireland at the start and end of the temporary assignment.

The tax-free subsistence is limited to 12 months, plus the vouched cost of one return trip per year (for a maximum of 2 years) to the home location may also be paid or reimbursed free of tax. This applies to the assignee, their spouse, and children. When an assignee’s spouse and children do not accompany them, the cost of one return trip per year to Ireland for the spouse and their children may be paid or reimbursed free of tax.

To learn about the full Tax Services offered by Immedis, download our taxation brochure.